When opening a trust, most parents ask, "What can a special needs trust not pay for?"

Special needs trusts cannot pay for direct cash payments to beneficiaries, certain food and shelter expenses that aren't properly structured, costs already covered by government programs, gifts to others, or illegal purchases.

According to the Social Security Administration's guidelines on Supplemental Security Income, these prohibited expenses can reduce or eliminate critical benefits like SSI and Medicaid. Understanding these restrictions is essential for trustees managing funds for individuals with disabilities; one mistake could jeopardize your loved one's financial security and access to healthcare.

Want expert guidance delivered to your inbox? Subscribe to The Autism Voyage Newsletter for weekly tips on special needs planning, trust management, and disability benefits; straight from professionals who understand your journey.

Key Takeaway:

- A special needs trust can improve quality of life without reducing benefits when structured properly.

- Trustees must understand what NOT to pay for, especially direct cash, improperly structured food, and shelter costs.

- Food and housing payments can trigger the one-third SSI reduction rule under in-kind support guidelines.

- First-party and third-party trusts follow different funding and payback rules.

- Paying vendors directly helps protect SSI and Medicaid eligibility.

- Detailed recordkeeping and compliance with SSA and IRS rules are essential.

- When unsure, review the trust terms carefully before approving any distribution.

Review this guide on types of special needs trusts, to better understand the structure differences. Choosing the right trust type from the start can prevent costly benefit mistakes later.

Table of contents:

- Understanding Special Needs Trusts

- What Can a Special Needs Trust Not Pay For?

- Food and Shelter: The Most Confusing SNT Restrictions

- What Can a Special Needs Trust Pay For?

- Trustee Responsibilities & Management

- Compliance, Oversight & Funding Considerations

- How The Autism Voyage Can Help

- FAQs

Understanding Special Needs Trusts

When parents ask what a trust cannot pay for, they are really asking how special needs trusts work. These trusts protect SSI and Medicaid when structured properly. They keep assets from counting toward the $2,000 SSI limit if spending follows strict rules.

In 2024, if John received $500 in cash, his SSI could drop from $943 to about $463, which may also affect Medicaid in some states.

Look at the comparison chart below for First-Party vs Third-Party:

| Category | First-Party SNT | Third-Party SNT |

|---|---|---|

| Source of Funds | Beneficiary’s own assets (settlement, backpay, inheritance received directly). | Funded by parents or others before assets reach the beneficiary. |

| Medicaid Payback | Required at death before heirs receive anything. | No Medicaid payback required. |

| Direct Cash Distributions | Reduces SSI dollar-for-dollar after $20 exclusion. | Same SSI reduction rule applies. |

| Food & Shelter Payments | Triggers In-Kind Support reduction (up to $314/month in 2024 under one-third rule). | Same reduction rule applies. |

| Gifting or Transfers | Highly restricted; improper transfers may violate trust and benefit rules. | Also restricted, but legacy planning flexibility remains. |

| Age Restrictions | Must generally be established before age 65. | No age restriction for creation. |

| Oversight & Reporting | Often court-involved or state-reviewed depending on origin. | Typically privately managed with trustee discretion. |

| End-of-Life Distribution | Remaining funds reimburse Medicaid first. | Remaining funds pass to named heirs. |

First-party trusts must repay Medicaid under SSA POMS SI 01120.203. Improper payments can reduce SSI under SSA POMS SI 00835.400. Many families consider funding a special needs trust with life insurance for long-term protection.

Review the practical steps in this guide on how to set up a special needs trust before making decisions, to avoid costly benefit reductions or compliance mistakes.

What Can a Special Needs Trust Not Pay For?

When it comes to special needs trust and SSI, certain expenses are strictly prohibited. These payments can be treated as income or in-kind support under SSI rules. That can lead to benefit reductions or even temporary suspension.

Trustees must know which expenses are prohibited before making distributions:

- Direct cash payments to the beneficiary — SSI is reduced nearly dollar-for-dollar after the $20 general income exclusion.

- Improperly structured rent or mortgage payments — may trigger in-kind support reductions under shelter rules.

- Groceries or direct food purchases for basic support — can reduce SSI by up to one-third of the federal benefit rate.

- Utilities such as gas, electric, water, or sewer when treated as shelter expenses.

- Medical or therapy costs already covered by Medicaid or another government program.

- Gifts, loans, or transfers to other individuals that violate trust terms.

- Illegal purchases or prohibited transactions that create compliance violations.

Explore structured guidance through Special needs financial planning services to help protect benefits and avoid costly mistakes.

The Impact of Prohibited Expenses on Government Benefits

Improper trust spending can quickly reduce or suspend benefits. Direct cash payments lower SSI under income rules. Food and shelter support can trigger the one-third reduction rule and affect Medicaid eligibility.

The consequences may include:

- SSI reduced dollar-for-dollar for direct cash payments after the $20 exclusion.

- SSI reduced up to one-third for food or shelter support under in-kind support rules.

- Temporary SSI suspension if income or resource limits are exceeded.

- Medicaid disruption or loss in states where Medicaid follows SSI eligibility.

- Overpayment notices from SSA, requiring repayment of benefits already received.

- Closer review and monitoring of future trust distributions.

Food and Shelter: The Most Confusing SNT Restrictions

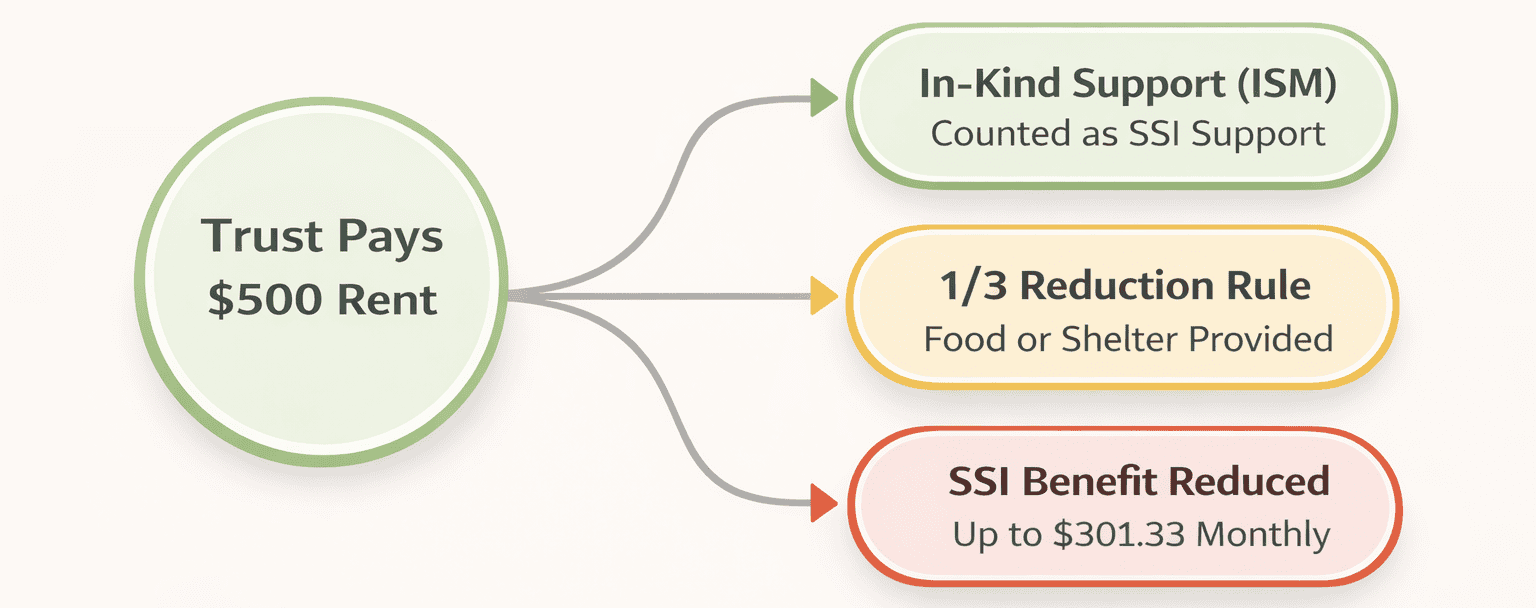

Food and housing payments are the most misunderstood trust rules. Under in-kind support and maintenance, SSI treats certain support as income. This usually applies when a trust pays for rent, groceries, or utilities. These payments can reduce monthly SSI benefits even if no cash is given directly.

SSI applies the “one-third reduction rule” when food or shelter is provided. This means benefits can be reduced by up to one-third of the federal rate. If the trust pays $500 per month in rent, SSI may be reduced by up to $301.33. Trustees must structure housing and food payments carefully to avoid unnecessary benefit loss.

What Can a Special Needs Trust Pay For?

A special needs trust can cover many quality-of-life expenses when structured properly. Parents often ask, can a special needs trust pay for house maintenance, and it can if vendors are paid directly.

The key is protecting SSI and Medicaid by knowing this list:

| ✔ Can Pay For | ✘ Cannot Pay For |

|---|---|

| • Medical and dental care not covered by Medicaid • Therapy and educational programs • Transportation and vehicle expenses • Assistive technology and devices • Home modifications and repairs • House maintenance (paid directly to vendors) • Personal care attendants • Recreation, vacations, and hobbies • Electronics and internet services • Professional services (legal, financial, care management) | • Direct cash to the beneficiary • Improper rent or mortgage payments • Groceries or food treated as support • Utilities structured as shelter support • Expenses already covered by government programs • Gifts, loans, or transfers to others • Illegal purchases or prohibited transactions |

Paying third-party providers directly is generally allowed. Direct cash or improperly structured food and shelter payments can reduce SSI. Trustees should review distributions carefully before approving payments.

Trustee Responsibilities & Management

A trustee must manage the trust carefully and protect public benefits. Every trust distribution must follow SSI and Medicaid rules. Oversight and documentation are essential. The core responsibilities include:

Act in the beneficiary’s best interest at all times.

Make payments directly to vendors, not to the beneficiary.

Avoid direct cash distributions that could reduce SSI.

Understand SSI and Medicaid impact rules before approving payments.

Keep detailed records and receipts for every transaction.

Follow the trust terms strictly to remain compliant.

Strong administration helps prevent benefit reductions and legal issues. Careful decision-making protects both current eligibility and long-term stability. When in doubt, distributions should be reviewed before funds are released.

Compliance, Oversight & Funding Considerations

Trust compliance requires strict reporting, tax filings, and funding oversight. Trustees must follow legal rules to protect benefits and manage the distribution of trust assets to beneficiaries after death. The key requirements lists:

- Follow state-specific trust laws and court requirements.

- Complete required annual accountings or reports.

- Maintain detailed records and receipts.

- File required IRS Form 1041 when applicable.

- Understand whether beneficiaries pay taxes on irrevocable trust distributions under distributable net income rules.

- Follow federal trust regulations under SSA POMS SI 01120.200.

- Follow in-kind support rules under SSA POMS SI 00835.400.

- Know funding differences between first-party and third-party trusts.

- Maintain strict trustee control over withdrawals.

- Avoid common mistakes such as direct cash payments or improper shelter support.

Current SSI federal benefit rates and resource limits are published annually by the Social Security Administration, and trustees should review updated SSA and IRS regulations each year to remain compliant.

Challenges in SNT Administration

Administering a special needs trust involves strict rules and ongoing oversight. Direct payment restrictions and state-specific requirements add complexity. Professional management costs and reporting duties must also be considered.

Common challenges include:

- Complex setup and legal drafting requirements.

- Restrictions on direct cash payments to beneficiaries.

- State-specific rules and compliance limitations.

- Ongoing reporting and documentation requirements.

- Professional trustee or administration costs.

How The Autism Voyage Can Help

Navigating trust rules can feel overwhelming. The Autism Voyage provides educational resources to explain trust management and benefit protection. Our goal is to provide clarity so families can make confident decisions.

Here are the ways The Autism Voyage supports families:

- Help understanding compliance rules and benefit protection through educational content and structured guidance

- Explanations of state-specific considerations so families know which questions to raise with their professionals

- Education around trust funding strategies and long-term planning to support informed decision-making

- Resources to avoid common trustee mistakes and benefit reductions through practical awareness tools

To best help with your financial clarity journey, reach out to us! We’re here for you every step of the way.

FAQs

Families often ask practical questions about what a special needs trust can pay for. The answer usually depends on how the payment is structured. Protecting SSI and Medicaid is always the priority.

In general, trusts can pay for vacations, vehicles, and approved services when vendors are paid directly. Housing and rent may reduce SSI if not structured correctly. Food payments can also trigger the one-third reduction rule.

Can a special needs trust pay for vacations?

Yes, a trust can pay for vacations and travel expenses. Payments should be made directly to airlines, hotels, or vendors. Avoid giving cash directly to the beneficiary.

Can a special needs trust pay for housing?

Housing payments can affect SSI if not structured properly. Shelter support may trigger the one-third reduction rule. Trustees must understand in-kind support rules before paying.

Can a special needs trust pay for food?

Food payments can reduce SSI under in-kind support rules. Even groceries paid directly may count as support. Careful planning is required to avoid benefit reduction.

Can a special needs trust pay for rent?

Rent payments can trigger SSI reductions under shelter rules. SSI may reduce benefits by up to one-third of the federal rate. Trustees should structure housing payments carefully.

Can a special needs trust pay for a car?

Yes, a trust can purchase a vehicle. The trust should pay the dealership or lender directly. Ongoing expenses like insurance and maintenance are generally allowed when properly managed.